Empowering Tesla Owners: Unraveling the Insurance Puzzle

Average Cost to Insure a Tesla

Insuring a Tesla can be more expensive than insuring a comparable gas-powered vehicle. According to 2021 rate data, here are the average annual premium costs to insure a Tesla:

- Tesla Model 3 - $1,913 per year

- Tesla Model S - $2,473 per year

- Tesla Model X - $2,934 per year

- Tesla Model Y - $2,043 per year

These rates are 27% to 71% higher than average premiums for other midsize luxury cars like the BMW 3 Series or Porsche Cayenne. Several factors contribute to the high insurance costs for Teslas:

- The vehicles have a high starting price, which raises their repair costs

- Tesla's advanced tech and aluminum construction are expensive to fix after accidents

- Insurers classify them as high-performance sports cars

- Data on claims and repairs is still limited for Tesla models

While Tesla insurance comes at a premium, dedicated EV owners may find the costs worthwhile. But you can take steps to find the best rates, which we'll cover throughout this guide.

Tesla Insurance vs Traditional Auto Insurance

Tesla insurance offers some key differences compared to traditional auto insurance providers when it comes to pricing, discounts, and the repair process. Here are some of the major differences:

- Pricing factors - Tesla insurance pricing is based primarily on the make/model of the vehicle, whereas most traditional insurers price based on more factors like driver age, credit score, and location. This allows Tesla to offer lower rates for safer vehicles.

- Discounts - Tesla provides discounted premiums for enabling safety features like Autopilot. Most traditional insurers don't account for advanced safety tech in discounts.

- Repair process - Tesla controls the repair process including parts procurement and authorizing repairs at Tesla Approved Body Shops. Traditional insurers work with third-party body shops.

- Claims processing - Tesla can pull diagnostic data from the vehicle to help with claims processing. Traditional insurers rely on estimates and adjuster assessments.

By pricing based on the vehicle itself, offering discounts for safety features, controlling the repair process, and leveraging vehicle data, Tesla provides a unique insurance product catered specifically for Tesla owners. However, traditional insurance providers still tend to offer more flexibility with coverage options.

Factors That Impact Tesla Insurance Rates

There are several key factors that play a role in determining Tesla insurance rates, including:

- Vehicle Cost - Teslas are significantly more expensive than the average car, often costing $80,000+ for a new Model S or X. More expensive vehicles typically cost more to insure.

- Safety Features - Teslas come standard with advanced autopilot and safety technologies like automatic emergency braking. These can lower insurance costs due to reduced risk.

- Driver Profile - Your age, driving history, credit score, and other standard rating factors still impact your rates. Teen and high-risk drivers pay more for Tesla insurance.

Insurers have to account for the higher repair and replacement costs of Teslas when setting rates. But advanced safety features and autopilot can potentially offset some of that risk and result in lower premiums compared to other luxury vehicles.

Overall, Tesla insurance costs more than the average vehicle, but may be lower compared to insuring other cars in the same premium class once all rating factors are considered.

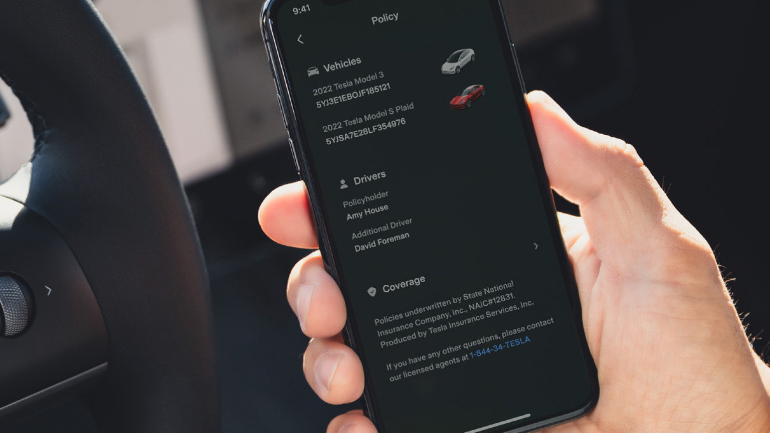

2.1. Tesla's In-House Insurance Product

- Tesla launched its own in-house insurance product in 2019, starting in California and slowly expanding to other states.

- Tesla Insurance is priced using a variety of factors, including real-time driving behavior data collected from customers' Tesla vehicles.

- Premiums are determined on a monthly basis and have the potential to decrease for safe driving.

- Coverage options include comprehensive and collision damage, uninsured motorist protection, and personal injury protection.

- Customers have access to Tesla's service centers and technicians for repairs.

Tesla's in-house insurance product aims to leverage the advanced technology built into Tesla vehicles to price insurance based more on an individual's driving behavior. By collecting granular data like mileage, frequency of hard braking, and other metrics, Tesla Insurance can adjust premiums based on real-world usage and safety. This contrasts with traditional insurance which relies more heavily on general factors like age and location.

The launch of its own insurance product allows Tesla to potentially lower costs for owners, provide a more seamless customer experience, and further differentiate its vehicles. However, the product is still only available in a limited number of states so far. As Tesla collects more driving data and launches the product more widely, it will offer an intriguing option for Tesla owners looking to insure their vehicles.

2.2 Shopping With Independent Providers

In addition to Tesla's own insurance product, many independent insurance companies also offer policies for Tesla vehicles. Here are some tips for shopping around with other insurers:

- Get quotes from several major national companies like State Farm, Allstate, GEICO, and Progressive. Local and regional providers are also worth considering.

- Use online quote comparison sites to quickly see rates from multiple providers side-by-side.

- Provide the same coverage details to each company so you can accurately compare quotes.

- Ask about all available discounts you may qualify for as a Tesla owner.

- Consider usage-based insurance programs that track actual driving data.

- Look beyond just price - also compare customer service reviews and claims satisfaction ratings.

- Review policy details carefully to ensure you are getting the coverage you need.

Shopping around for quotes rather than just going with Tesla's insurance can help ensure you get the best possible rate. Independent agents may also be able to provide personalized advice to make sure you have adequate protection.

Comparing Quotes to Find the Best Rate

When shopping for Tesla insurance, it's important to compare quotes from multiple providers to find the best rate. Here are some tips for comparing Tesla insurance quotes:

- Get quotes from Tesla as well as 3-5 independent insurance companies. Rates can vary widely between providers.

- Compare the same coverage limits and deductibles across each quote. This creates an apples-to-apples comparison.

- Look beyond just the premium. Also compare any discounts offered, customer service ratings, claim satisfaction scores, and additional benefits.

- Check the insurer's financial strength rating to make sure they are financially stable.

- Review policy exclusions and limitations carefully. A cheaper premium may hide less coverage.

- Inquire about usage-based insurance programs, which can potentially offer lower rates for safe drivers.

- Ask about bundling your Tesla with other insurance policies for a multi-policy discount.

Doing your homework by comparing multiple Tesla insurance quotes will help you find the best blend of rate, coverage, and customer service for your needs and budget.

3. Why Tesla Insurance Can Be Expensive

3.1. High Initial Vehicle Cost

- Tesla vehicles have a higher starting price than most other vehicles on the road today.

- The Model 3 has an MSRP starting around $46,000, the Model Y around $65,000, and the premium Models S and X over $100,000.

- Since insurance rates are partly based on the value of the car, insuring a more expensive vehicle typically costs more.

- Even Tesla's most affordable model, the Model 3, costs significantly more than the average new car price of around $38,000.

The advanced technology and premium brand status of Tesla leads to high initial vehicle costs. This results in higher insurance premiums compared to insuring a typical family sedan or crossover SUV from a mainstream brand. Due to their cutting-edge nature, Teslas are categorized into a higher insurance risk tier by providers.

3.3. Complex Repair Process

One factor that contributes to high insurance rates for Teslas is that they require specialized repairs due to advanced technology. Tesla vehicles have sophisticated features like sensor suites, large battery packs, and self-driving capabilities. When these components get damaged, mechanics need extra training and equipment to properly fix them.

- Tesla uses a high voltage battery pack unlike traditional internal combustion engine cars. Not all auto body shops are equipped to safely service these systems.

- The body is made of specialized aluminum alloy that requires dedicated tools and procedures for repairs.

- Sensors used for driver assist and self-driving features need to be calibrated after being replaced.

- Many components are closely integrated, so damage in one area may impact adjoining systems.

Because of the complexity, getting Tesla collision repairs through traditional body shops may not restore the vehicle to pre-loss condition. Using Tesla's approved repair centers ensures proper repairs but also increases costs that get passed on in higher insurance rates.

Limited Choice of Body Shops

Tesla insurance claims often require repairs at authorized Tesla body shops due to the complexity of repairing these vehicles. Here are some key points on the limited body shop options for Tesla repairs:

- Most standard auto body shops are not equipped or certified to work on Teslas, which require specialized training, tools, and parts.

- There are only a few dozen authorized Tesla collision centers across the U.S., concentrated in certain major metros.

- Many insurance companies mandate the use of Tesla-approved body shops for covered repairs.

- Lack of certified shops can lead to delays getting a damaged Tesla repaired and back on the road.

- If no Tesla-approved shop is conveniently located, the insured may need to pay for towing to transport the car a long distance.

- The limited certified repair facility network makes Tesla repairs less convenient and likely more expensive.

3.3. Advanced Safety Features

One of the main factors that increases insurance costs for Teslas is the vehicles' advanced safety features. Tesla's Autopilot system, automatic emergency braking, forward collision warning, and other high-tech safety components help prevent accidents. However, they also increase repair costs significantly when accidents do occur.

For example, repairing damages to Tesla's ultrasonic sensors, cameras, and radar tech is expensive due to part costs and specialized labor. Replacing a front radar sensor alone can cost thousands of dollars. Insurers factor in these higher potential repair bills when pricing policies.

- Tesla's advanced safety features help avoid accidents, but increase repair costs

- Replacing sensors, cameras, and other components is expensive

- Insurers price this increased risk of high-cost repairs into premiums

- Drivers with accident-avoidance tech often pay higher premiums

Tesla owners can't avoid paying for this extra risk, as the advanced safety features come standard. But understanding the "why" behind the high premiums can help drivers better accept the insurance costs.

Choose Higher Deductibles

One way to potentially lower your Tesla insurance premium is to choose a higher deductible. A deductible is the amount you'll pay out-of-pocket when you file a claim before your insurance coverage kicks in. Here are some benefits of choosing a higher deductible:

- Lower monthly premium - Choosing a higher deductible like $1,000 or $2,500 can reduce your monthly premiums by 10-40%. This can lead to significant savings over the course of a policy term.

- Less minor claims - With a high deductible, you may avoid making smaller claims for minor repairs and dents that are under your deductible amount. This helps keep your premiums low.

- Rewards safe driving - Opting for a higher deductible shows your insurer you are a lower risk, as you are willing to take on more out-of-pocket costs in the event of an accident.

Of course, you'll want to choose a deductible amount you can comfortably afford to pay if you do need to file a claim. But raising your deductible from the minimum can be an effective way to get lower Tesla insurance rates.

Ask About Discounts

One way to potentially lower your Tesla insurance premium is to ask about available discounts. Here are some common discounts Tesla owners may qualify for:

- Multi-policy discount - You may save by bundling your Tesla insurance with other policies like homeowners or renters insurance.

- Good driver discount - Having a clean driving record with no accidents or tickets can earn you a lower rate.

- Safety feature discount - Teslas come standard with advanced safety features like automatic emergency braking, which providers may offer discounts for.

- Low mileage discount - Driving fewer annual miles can qualify you for a lower premium.

- Autopilot discount - Using Tesla's Autopilot advanced driver assistance system may make you eligible for discounted rates.

Be sure to ask your insurance agent or provider about any discounts for anti-theft devices, new vehicle discounts, affinity or alumni group discounts, and more. Every discount can help lower your bottom line, so take the time to inquire about any you may qualify for.

Improve Your Credit Score

Better credit can lower premiums.

One of the biggest factors that impacts your auto insurance rates is your credit score. Insurance companies have found that drivers with poor credit tend to file more claims compared to drivers with excellent credit.

As a result, improving your credit score can directly translate to lower insurance premiums. Here are some tips for boosting your credit score:

- Pay all your bills on time - Set up automatic payments or payment reminders to avoid missed or late payments.

- Pay down credit card balances - Try to keep balances below 30% of the credit limit.

- Limit new credit applications - Too many hard inquiries from applying for new credit can ding your score.

- Correct errors on your credit report - Dispute any inaccuracies you find that could be bringing down your score.

Request a free copy of your credit report from AnnualCreditReport.com. Review it carefully and dispute any errors with the credit bureaus. Over time, responsibly managing credit and paying all bills on time can improve your credit standing.

Many insurers will rerun your credit periodically and adjust rates accordingly. Maintaining excellent credit can be one of the best ways to secure the lowest possible insurance premium for your Tesla.

4.4. Enroll in Usage-Based Insurance Program

Tesla's insurance pricing factors in individual driving data collected by your vehicle. Tesla currently offers two usage-based insurance options, using data gathered directly from your car's onboard computer.

- Basic usage-based insurance adjusts premiums monthly based on miles driven with Autosteer engaged, following speed limits, hard braking, and aggressive turning.

- With Advanced usage-based insurance , even more driving factors are assessed such as the types of roads driven, time of day, traffic congestion, weather, trip duration, and safety features used.

Opting in to a usage-based insurance program and practicing safe driving habits can lead to significant discounts. By sharing your driving data directly with Tesla or independent insurers you could save up to 30% or more on your premium.

Lower rates will reflect driving patterns that statistics show result in fewer accidents like following speed limits, avoiding erratic acceleration, turning gently, and staying focused on the road.

Tesla Insurance Availability by State

Tesla insurance is currently only available in select states, with plans to expand nationwide in the future. Here is an overview of Tesla insurance availability:

Currently Available States

Tesla currently offers insurance in the following states:

- California

- Texas

- Illinois

- Colorado

- Ohio

- Arizona

Upcoming Launch States

Tesla has announced plans to expand its insurance products to the following states in the near future:

- Washington

- Virginia

- Maryland

- Oregon

- North Carolina

States With No Official Launch Plans

Any states not mentioned above currently have no official launch timeline for Tesla insurance. This includes major markets like:

- New York

- Florida

- Pennsylvania

- New Jersey

Post a Comment